Voters in the U.K. will decide June 23 whether the country should remain part of the European Union. (Photo/Dave Kellam)

The ‘Brexit’: USC experts share what you need to know about the referendum

Voters in the U.K. will decide June 23 whether the country should remain part of the European Union

The “Brexit” — the June 23 United Kingdom referendum on whether to leave or remain in the European Union — could prove costly for Great Britain and may affect its trade and diplomatic relations, including with the United States. The latest polls shows British citizens are evenly split on the issue.

Following Thursday’s tragic death of Jo Cox, a member of Parliament for the Labour Party, both sides suspended their campaigns.

The country joined the EU in 1973 and has had a complicated relationship with the body, from arguing Eurozone costs to a 27-year battle over the content of chocolate bars. Both sides of the Brexit issue argue there are significant cost savings associated with their position.

Here USC experts share their thoughts and impressions about the referendum and its possible effects.

Why do some voters want to leave in the first place?

“Contrary to what the leave supporters are claiming, a decision by the United Kingdom to leave the European Union might not have much of an effect on reducing the fairly limited pressure that the U.K. is currently experiencing from asylum seekers and non-EU migrants. A ‘leave vote’ might actually result in the U.K. experiencing growing pressure from asylum seekers and non-EU economic migrants because other EU states would no longer be obligated under EU law to cooperate with the U.K. on migration.”

NIELS FRENZEN

Expert in refugee and asylum law with the USC Gould School of Law

How will global businesses respond to an exit?

“No country has left before — there is no benchmark in terms of what can happen. In terms of winners and losers, the companies that have opted to locate their headquarters in Britain may reconsider and relocate to another country to participate in a bigger economy. Corporations will not hesitate to make this decision.

“There are a lot of data points that suggest Britain would isolate itself and lose its influence in Europe. There are more disadvantages with exiting the European Union; I do not see distinct benefits. The bottom-line savings will have only a small impact, and there is a strong likelihood the decision to exit will have dark consequences.”

NICK VYAS

Director of the Center for Global Supply Chain Management and assistant professor of clinical data sciences and operations at the USC Marshall School of Business

Will this shake up the financial markets?

“Big financial players (in the U.S.) are moving their money and hedging. It is likely that a bank like Goldman Sachs will move thousands of workers if there is a Brexit. In addition to the tax ramifications for businesses, cancer research will also move onto the continent. European cities are all waiting to welcome the fleeing businesses, and Scotland will likely leave the United Kingdom, causing more instability.

“The Brexit will be very hard to reverse as it’s all about confidence and stability. All data points to Brexit being purely based on nativist rationales. There is no economic evidence to back its rationale. It’s like a national suicide: Foreign investment is dropping fast. This is madness.”

JACOB SOLL

Expert on accounting practices at the USC Dornsife College of Letters, Arts and Sciences and the USC Leventhal School of Accounting

Are there implications for the U.S. if Great Britain votes to leave the EU?

“Today’s murder of Jo Cox, a member of Parliament, painfully highlights the tension in the United Kingdom that is evolving in the course of the Brexit debate. The stability of U.S. relationships with the U.K. and with the European Union may very well be at risk here. The outcome of this vote could seriously impact global relationships of some consequence.”

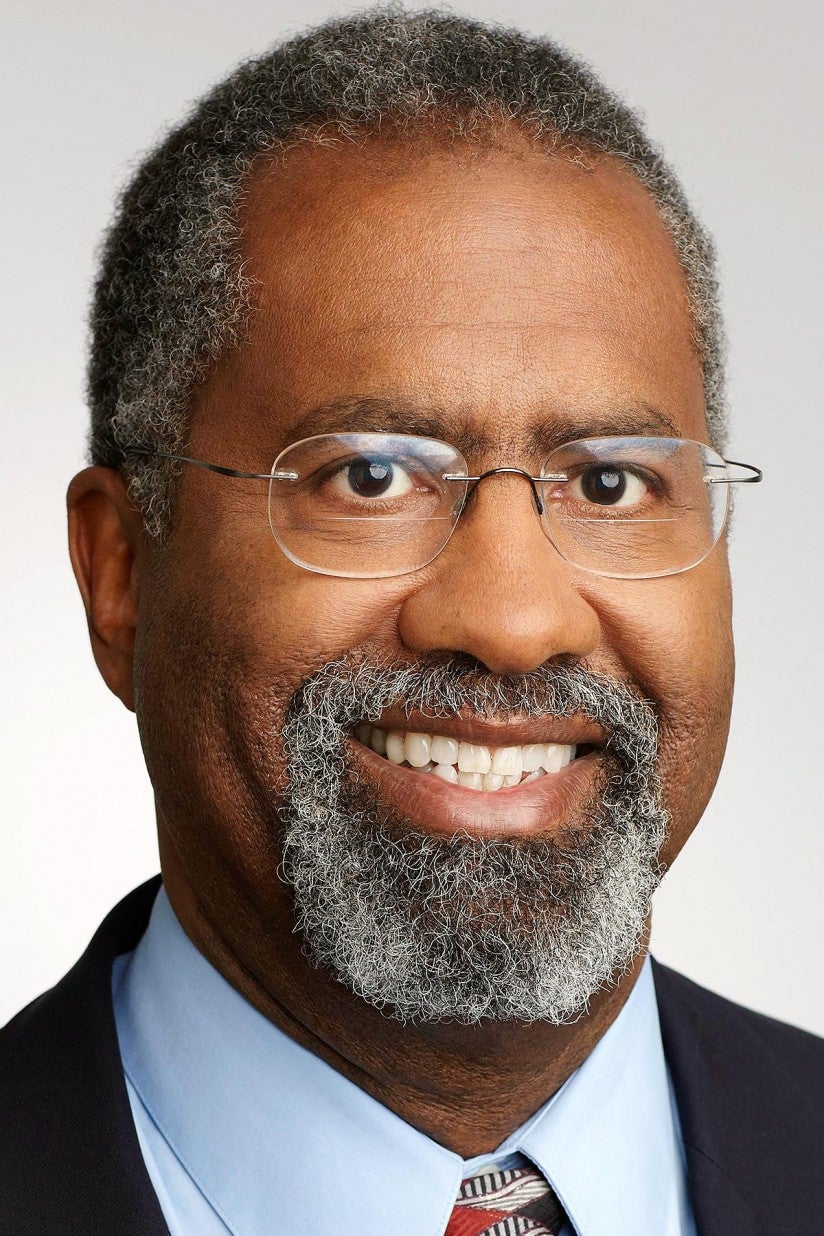

EDWIN SMITH

International law expert with the USC Gould School

Is there no turning back?

“Although an extremely important vote faces the British people, my impression is that both sides exaggerate the consequences of failing to adopt their position. If Britain votes to leave the European community, despite all arguments to the contrary, it undoubtedly will be given a second chance to return, and very likely with substantially more power to address its concerns about Pan-European policies. And even if not, its proximity to mainland Europe ensures that it will always be an important trade partner to the European community. However, Britain will incur significant transition costs if it leaves.”

LAWRENCE HARRIS

Expert in stock markets, investment, regulation and economic forecasting in the USC Marshall School, and former chief economist of the Securities and Exchange Commission